There are a lot of generic articles online about how to increase customer lifetime value.

This is not one of those posts.

We’ve gone through some of the most valuable ways to improve your LTV and found examples of what real brands are doing today.

Get ready, this is going to be a good one.

Customer lifetime value (LTV) is the total revenue generated from a customer during the entire duration they do business with you. LTV is an important metric because it can help businesses understand how much value each customer brings to their bottom line.

Knowing LTV is important because it can inform what marketing initiatives will bring a positive ROI. It also helps you determine how much you can spend to acquire a customer.

Your LTV will help you understand what your customer acquisition cost (CAC) should be. If your CAC is higher than your LTV, your business will be losing money. But if your CAC is lower than your LTV, your business will be making money.

But calculating your lifetime value, and understanding what is an appropriate cost to acquire a customer, can take some time. Ideally, you want to be doing business for at least a year to calculate this number accurately. The longer you’re in business, the easier it will be to calculate LTV.

Let’s talk about why.

Calculating your customer lifetime value (CLV) is something every startup needs to do.

Here’s a simple formula you can use to calculate your customer’s LTV:

LTV = Average Revenue Per Customer x Average Customer Lifespan

Here’s an example in the real world: Let’s say you’re a SaaS company that sells a service for $100 a month. On average, a customer stays subscribed to your software for 18 months. (Note that this is an average, some customers can churn in 1 month, while others may not churn for 36 months).

In this case, your LTV would be: $100 x 18 months = $1,800

This means that each customer, on average, is worth $1,800 for your business.

With this number, you can now get a better picture of what marketing campaigns make sense for you. For example, if you spend $1,000 on ads and only get 1 customer. In the short term, you’ll be losing money, and it may seem like a bad investment to have such a high customer acquisition cost. But because you know your LTV, you can make the conclusion that, in the long run, you’ll be making money.

But you’re also spending more than half of your LTV to acquire that customer. So you’ll want to be smart and forecast your financials accordingly (both short and long-term).

Note: LTV calculations vary greatly on the time frame you use. This is why, even though it’s a simple calculation, it’s a tricky one. The longer you’ve been in business, the more accurately you’ll be able to calculate this number, as you’ll have gone through seasonal trends multiple times.

An accurate LTV could take years to figure out, and it’s almost impossible for any new businesses under a year old.

Regardless, even if you don’t know 100% what your average customer lifespan is going to be, it is a good idea to have the benefit of foresight and try to increase your revenue per customer as much as possible.

Let’s go over seven ways you can increase your revenue per customer and increase your overall LTV.

Here are seven ways to increase your customer lifetime value (LTV):

Okay, let’s dive a bit deeper into each one.

At a first glance, you may not think that providing a great customer experience is the number one way to increase your LTV.

But if you think about the LTV formula we went over, one of the inputs to that equation is your average customer lifespan.

In other words, your average customer lifespan is all about customer retention.

In a study from Zendesk, it was reported that 42% of customers said they bought more from a company after they had a positive customer service experience.

In that same study, it was reported that 97% of people change their buying behavior after a bad customer service experience.

This pretty much concludes that failing to provide great customer service can lead to customers not wanting to do business with you again.

This is why Chatdesk focuses so heavily on helping small to medium-sized businesses with their customer service. A great customer experience leads to loyal customers that stick around and help spread the word about your brand — helping you lower your customer acquisition costs.

If you’re a growing ecommerce, SaaS, or marketplace that needs help responding to customer inquiries, be sure to book a free pilot with Chatdesk!]

One of the easiest ways to increase the value of each new customer is to leverage upsells and cross-sells.

An upsell is when a company encourages its customers to upgrade to a better package or plan.

A cross-sell is when a company encourages its customer to purchase complementary products or services to the one they are currently purchasing.

A great example of a company that does upselling well is Apple.

When purchasing almost any Apple computer, Apple tries to upsell you on better processes, RAM, or storage.

Laying out these options allows Apple to easily upsell their customers — helping them increase their average order value (AOV).

Some SaaS companies also do a great job with this.

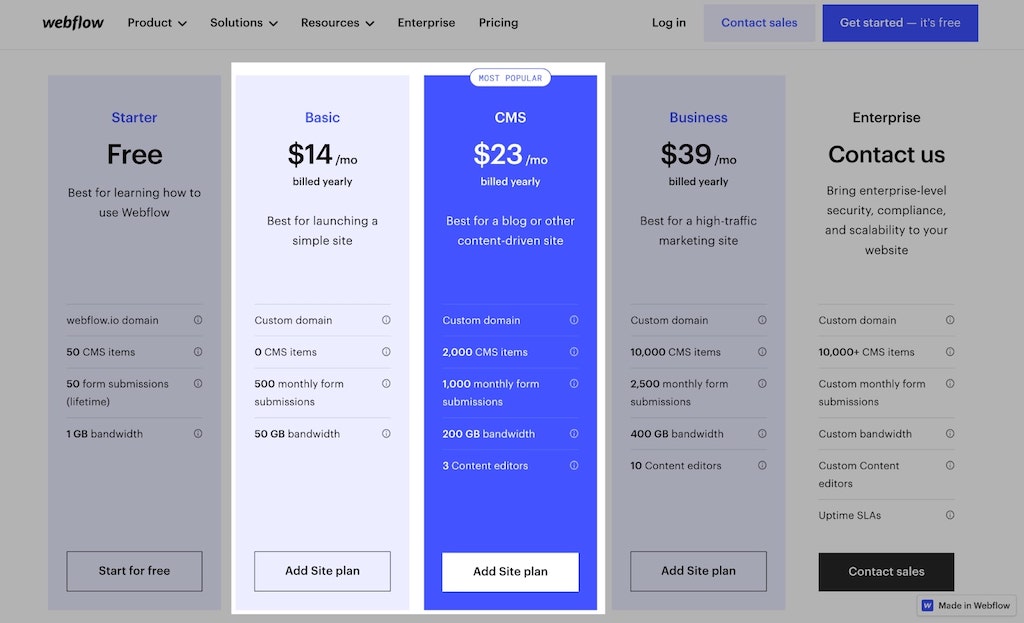

Webflow, the popular no-code website builder, upsells its customers to a higher-tier hosting plan if websites want to have a blogging CMS.

Both Apple and Webflow also use something called price anchoring, where the desired option is placed in the middle between a lower and higher price.

Many travel and airline companies also leverage upsells when booking with them. Whether it’s upgrading to a better hotel room or adding an extra checked bag, upsells can be seen in many different industries and verticals.

Cross-sells are also common among many companies, especially ecommerce companies.

Amazon is a great example of a company that has successfully leveraged cross-sells to grow its profit margins and increase the value of each cart.

This can be seen in the “frequently bought together” section of each product on Amazon.

Both upsells and cross-sells are a great way to increase the value of each customer and in turn, increase your overall customer lifetime value.

Another great way to get people to stick around and decrease your churn rate is through a referral program.

Customers trust recommendations from people they respect. And referral programs are great because they leverage the power of word of mouth.

As a result, referred customers are more likely to make a purchase over those that discover your product on their own.

Referred customers also tend to be more loyal because they were actively looking for a product or service like yours until someone recommended your brand to them.

A great example of a company leveraging a referral program can be seen with American Express.

American Express (AMEX) incentivizes its customers to refer their friends to open an AMEX account. In return, the referrer and the new customer both get bonus points that can later be redeemed for travel tickets, sporting events, or other rewards.

In the case of AMEX, existing customers are highly incentivized to spread the American Express brand with their friends, family, or colleagues. And, new customers are highly encouraged to sign up through existing customers, as they’ll get access to great sign-on bonus points.

The most successful referral programs create a win-win situation for both parties involved.

Loyalty programs are a great way to give back to your best customers. Showing your most valuable customers that you appreciate their commitment to you will help improve the length of each customer’s lifecycle.

You can see cafes and coffee shops do this with rewards cards. After coming in to buy a cup of coffee after a certain amount of time, your next coffee could be on the house.

This encourages customers to keep coming back for more so they can redeem their reward(s) — essentially helping you increase the number of purchases made by a given customer.

But this strategy isn’t just limited to local businesses. You can also use loyalty programs to send discounts or prizes to ecommerce or SaaS customers.

You could create an automation that emails your customers a discount code after they have spent a certain amount of money with you.

Or, after a certain amount of months with your SaaS product, you could encourage customers to upgrade their plan at a lower cost than what it would be for a brand new customer.

There are lots of different ways you could get creative with increasing the purchase frequency of your products or services through loyalty programs.

One of the best ways to increase your customer lifetime value, and to better forecast your LTV months (and even years) into the future, is to have a subscription model.

If you’re a SaaS company, you can skip this part because it’s already ingrained in your business.

But if you’re an ecommerce business, creating a subscription offering is a great way to create repeat purchases, improve your retention rate, and increase your LTV.

A great example of an ecommerce business doing this extremely well is Athletic Greens.

Athletic Greens sells a multivitamin green juice powder. A supply of 30 days worth of their product costs around $100. But if you decide to commit to a monthly subscription, where you’ll be sent a new batch of powder each month, the cost goes down to $79.

They even have an option that brings the total price of each month's supply even lower if you commit to 2 months upfront.

If you’re an ecommerce company, this is an extremely clever marketing strategy to create repeat business.

Building a community is all the rage these days when it comes to improving your customer relationships.

Humans are social beings.

If you can create an environment of like-minded individuals that come together to discuss topics related to the industry you’re in, you’ll be able to create a strong customer base that sticks around for a long time.

And a community doesn’t have to be a Facebook group or Discord Server. A community is simply a list of people that care about what you’re doing. This can be a following on social media, a subscriber base via email marketing and newsletters, or list of phone numbers you can leverage for SMS marketing.

A great example of a company building customer loyalty through a community is Clearscope. Clearscope is an SEO tool that helps businesses target the right keywords for their business.

And Clearscope built a large email list through weekly webinars with industry experts in the SEO and content space.

This show’s their commitment to helping their customers be successful, regardless of if they’re using their products or services. This free value-add then builds a strong relationship with existing customers and can even foster new business for them.

This last way to increase customer lifetime value sort of ties back into the first way we talked about — provide a better customer experience.

Calculating LTV consists of multiplying both price of your product and the duration a customer sticks around.

While you could increase your prices to boost your LTV, your main goal should be to keep a customer as long as possible. Having a high retention rate shows that you’re providing your customers with something that solves a pain point for them. And you’re solving it so well that they keep sticking around.

If people don’t stick around or become repeat customers, you’re going to have a hard time improving your customer lifetime value.

So your goal should be to find ways to decrease customer churn.

One strategy you can use if you’re a subscription company is to offer a discount if someone is about to churn. For example, if your SaaS product is $30/month and someone tries to cancel their plan, you can give them an offer for $20/month just to stick around longer.

This works for customers who churn because of price.

But high-value customers don’t churn often because of a pricing issue. Often times it could be that they either don’t need your product anymore or it’s not effectively solving their problem better than some other tools in the market.

So things like getting customer feedback from churned customers, finding gaps in your customer journey, decreasing friction during the checkout process, and improving your new customer onboarding are crucial to helping you decrease churn and increase LTV.

When it comes to knowing how to increase customer lifetime value, most people think it’s all about your marketing efforts.

While things like a referral program, loyalty program, and upsells can be seen as marketing tactics, sustainable growth comes from retaining your customers for as long as possible.

The longer you can hold onto a customer, the more they will pay you throughout the customer lifecycle.

Things like better customer support, creating new products, and proactively building a community of loyal fans of your brand are the pillars of decreasing churn and improving your LTV.

We hope you learned something from this post!

If you need help providing a great customer service experience for your customers, be sure to check out Chatdesk and see what it can do for you!